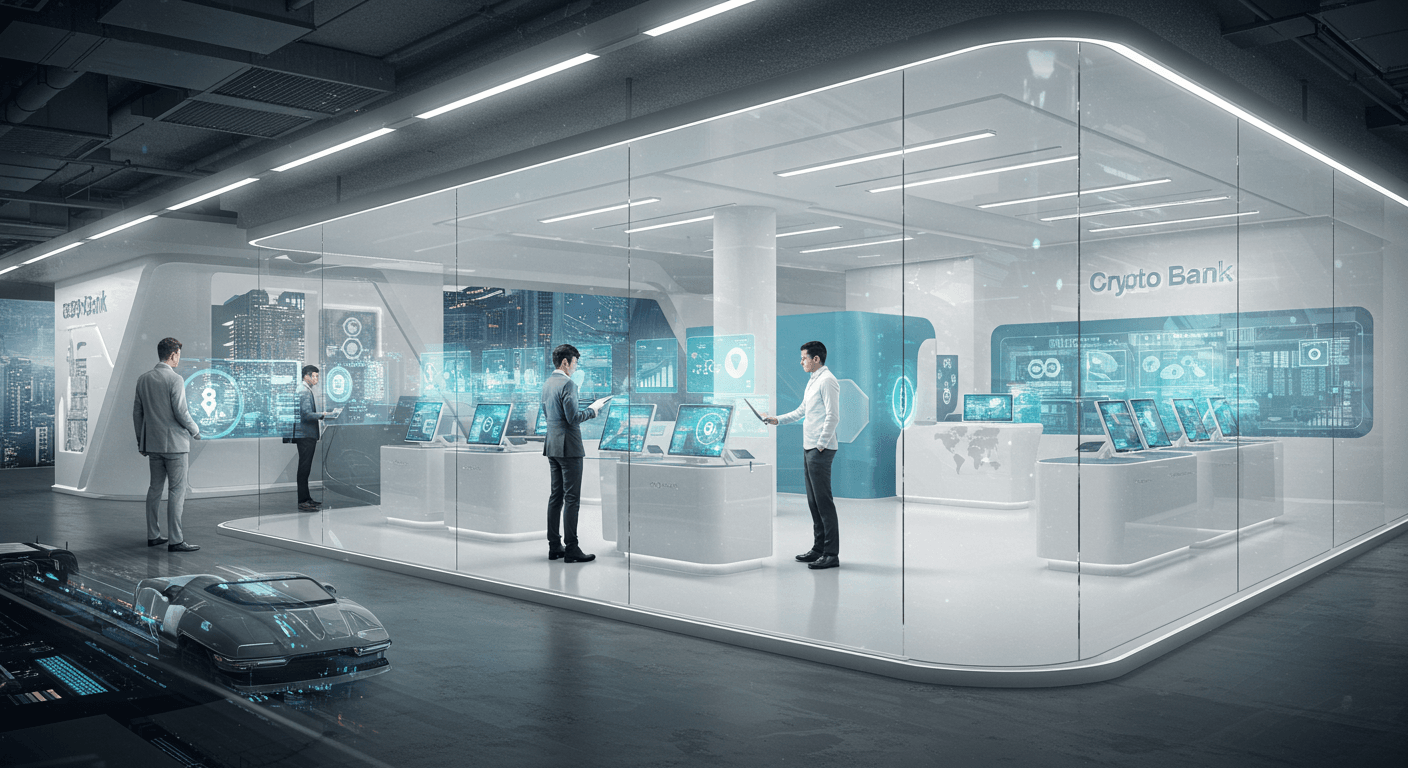

One of many coolest issues taht we like to jot down about at Good Information Collective is how persons are utilizing AI to launch new enterprise fashions. You may already see AI altering crypto banking by rushing up how companies are developed and managed.

A report from Fortune Enterprise Insights writes that the crypto market is predicted to develop 11.1 p.c a 12 months by way of the subsequent three years. It’s clear that this development is creating alternatives for entrepreneurs who need to create their very own crypto financial institution. Preserve studying to study extra.

You can begin by how generative AI is already being utilized to cryptocurrency programs. There are projections exhibiting that the generative AI market within the cryptocurrency house alone is predicted to develop in worth from 760 million {dollars} final 12 months to 1.02 billion {dollars} in 2025.

Ross Kelly from ITPRo writes that 84 p.c of software program builders are utilizing AI of their day by day workflows. You may acknowledge that this widespread adoption is making it simpler for even small crypto initiatives to achieve traction.

There are clear benefits to constructing a crypto financial institution with AI as a result of you’ll be able to design automated customer support programs. It’s also possible to create fraud detection instruments that alter to new dangers sooner than conventional strategies. You’re going to discover that these programs allow you to set up belief with customers in an rising market.

It is usually potential to depend on AI for compliance monitoring. There are regulatory pressures in each monetary sector, and AI can assist you observe exercise extra carefully with out hiring giant groups. You’re additionally going to search out that predictive analytics instruments can flag points lengthy earlier than they grow to be issues.

You may reap the benefits of machine studying fashions to research blockchain knowledge in actual time. There are fashions that may observe transaction speeds, establish bottlenecks, and counsel changes to maintain your crypto financial institution aggressive. It’s through the use of these sorts of insights you could stand out in a crowded market.

It’s changing into clear that AI is altering what it means to start out and scale a monetary service. You’re able to leverage these instruments for development whereas others are nonetheless studying the fundamentals. There are numerous methods AI can assist you automate duties that will in any other case decelerate your capacity to launch a working crypto financial institution.

The rise of digital belongings has redefined the monetary panorama. As extra prospects search banking companies that mix the comfort of conventional finance with the pliability of cryptocurrencies, the demand for crypto banking is rising at a speedy tempo. In response to PwC, over 200 banks worldwide are already participating in crypto-related initiatives, and the marketplace for crypto banking options is projected to increase steadily within the coming years.

For fintech startups and monetary establishments, velocity is all the pieces. Constructing a crypto financial institution from scratch usually requires years of improvement, excessive prices, and complicated compliance work. That is the place SaaS and white-label crypto banking software program come into play. These ready-made platforms present the infrastructure, integrations, and safety features wanted to launch a crypto financial institution in weeks, not years, whereas nonetheless permitting for customisation.

SDK.finance Crypto Banking Resolution: The Quickest Path to Launch

SDK.finance Crypto Banking Resolution stands out because the best choice for constructing a crypto financial institution rapidly and effectively. Designed as a white-label fintech platform, it presents each SaaS and supply code licence fashions, giving companies the pliability to decide on between velocity and full management.

Key Options

- Multi-asset administration: Assist for fiat currencies, cryptocurrencies, and tokens in a single pockets.

- Crypto-to-fiat operations: Seamless alternate and conversion capabilities, enabling purchasers to maneuver between asset courses with ease.

- Crypto debit playing cards: Issuing and administration of playing cards linked to crypto balances.

- 470+ APIs: Open integration layer for including new companies and scaling.

- Ledger-based basis: Ensures transparency, reliability, and scalability with over 2,700 TPS baseline efficiency.

- Safety & compliance: PCI DSS Degree 1 licensed, pre-integrated KYC/AML instruments.

Advantages

- Launch a crypto financial institution in weeks, due to pre-built modules and integrations.

- Select between SaaS for quick go-live or a supply code licence for full autonomy.

- Scale simply as transaction volumes and buyer bases develop.

- Guarantee cross-border compliance by way of adaptable structure.

Use Circumstances

- Nebeus: Leveraged SDK.finance to attach multi-currency accounts with crypto wallets, offering purchasers with versatile asset administration.

- Geidea: Used the SDK.finance ledger engine to increase its cost operations throughout MENA, processing thousands and thousands of day by day transactions.

Different Notable Crypto Banking Software program Options

Mambu

- Options: Cloud-native core banking engine with crypto integration prospects, robust API framework.

- Advantages: Versatile SaaS mannequin, extensively adopted by fintech startups.

- Time to Launch: Usually a number of months.

- Differentiator: Robust give attention to modular, composable banking infrastructure.

Temenos Infinity

- Options: Finish-to-end banking platform with crypto and tokenisation modules.

- Advantages: Appropriate for big banks coming into digital asset markets.

- Time to Launch: A number of months, relying on complexity.

- Differentiator: Depth of performance for advanced, large-scale banks.

Solaris

- Options: Banking-as-a-Service supplier with card issuing, IBANs, and crypto pockets help.

- Advantages: Presents regulatory cowl in Europe through partnerships.

- Time to Launch: Weeks to months.

- Differentiator: Licenced infrastructure mixed with crypto companies.

Bankable

- Options: Digital banking and cost options with crypto integration capabilities.

- Advantages: Fast deployment of wallets, funds, and card issuing.

- Time to Launch: Weeks.

- Differentiator: Give attention to partnerships with world cost networks.

Suggestions for Selecting the Proper Crypto Banking Software program

- Test for supply code entry: If long-term independence issues, guarantee the seller presents full code possession.

- Prioritise compliance: Search for pre-integrated KYC/AML options and PCI DSS certification.

- Scalability: Assess transaction throughput and talent to scale as your buyer base grows.

- Customisation choices: APIs and modular structure are important for tailoring the platform to your product imaginative and prescient.

Regulatory Concerns for Crypto Banking

Working a crypto financial institution requires strict adherence to rules. Relying in your jurisdiction, this will embody:

- Acquiring an Digital Cash Establishment (EMI) licence or equal.

- Implementing AML and counter-terrorist financing (CTF) insurance policies.

- Guaranteeing GDPR compliance for buyer knowledge if working in Europe.

Selecting a software program supplier that already helps these compliance necessities saves important effort and time.

Conclusion

Constructing a crypto financial institution not must be a multi-year mission. Crypto banking software program options like SDK.finance, Mambu, and Temenos present the technological spine for launching in a matter of weeks.

For startups and established monetary establishments alike, the appropriate selection is dependent upon balancing velocity, compliance, and management. With SDK.finance’s crypto banking answer, companies achieve a confirmed, versatile basis for coming into the market rapidly whereas making certain scalability and safety.

In case you’re able to construct a crypto financial institution in weeks, discover SDK.finance’s crypto banking answer and different platforms to search out the perfect match in your technique.

You may see that the rise of AI is tightly linked with the expansion of crypto banking alternatives. There are numbers from a number of reviews exhibiting how rapidly the market is increasing, and AI is the important thing driver that makes it simpler to take part.

It’s protected to say that entrepreneurs who lean on AI can have a bonus in constructing their very own crypto banks. You’re watching the muse of a brand new monetary sector that rewards these keen to undertake smarter instruments early.